Yes, you can, but moving tax deduction is valid only under certain conditions. Moving expenses used to be deductible for anyone who moved for work-related reasons, regardless of whether they itemized their deductions.

However, since 2018, the Tax Cuts and Jobs Act (TCJA) has suspended the moving expense deduction for most taxpayers, except for active-duty military members who move due to a permanent change of station.

This means that unless you are in the armed forces, you cannot apply for a tax deduction for moving from your federal income tax, even if you hire professional movers. One of my friends applied for tax dedication but it was refused as he wasn’t from the armed forces.

Who Can Deduct Moving Expenses?

You might think anyone who moves for work can claim their moving costs, but that’s not the case. The Tax Cuts and Jobs Act of 2017 stopped most people from being able to apply for a tax deduction for moving, but there are two exceptions:

Active-duty Military Members Who Qualify

If you move because of a lasting change of station and are in the military, you can still deduct your moving costs. This relocation tax deduction includes the cost of hiring skilled movers and the cost of getting there, staying there, and storing your things.

Taxpayers making changes to returns from before 2018

If you moved before 2018 but haven’t filed or changed your tax return for that year, you can still get credit for moving costs. But you must meet specific standards, like moving at least 50 miles closer to your new job and working full-time for at least 39 weeks in the first year after the move for moving tax deduction.

Some states still let you take deductions. Even though most people no longer get the federal moving cost deduction, some states still let you take it on your state income tax return.

Some states, like California, Massachusetts, New York, and Pennsylvania, let you subtract moving costs if you meet specific requirements. Check with your state’s tax office or an expert to see if this credit suits you.

What Expenses Qualify as Moving Expenses?

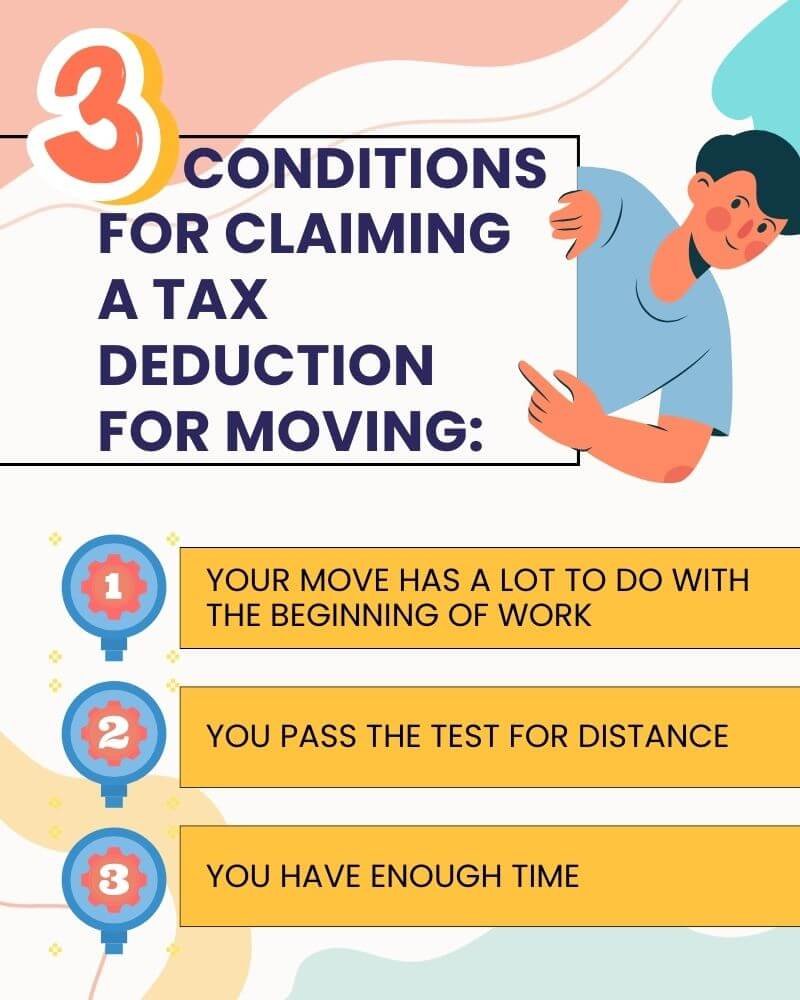

The IRS says that you can claim a tax deduction for moving if you meet three conditions:

Your Move Has A Lot To Do With The Beginning Of Work

This means that you move within a year of starting your new job and that the distance from your new home to your new job is not more than the distance from your old home to your new job.

You Pass The Test For Distance

This means that your new primary job location is at least 50 miles further from your old home than your old central job location was from your old home.

You Have Enough Time

This means that you have to work full-time for at least 39 weeks in the first year after you move to the area of your new job.

If you meet these requirements, you can deduct the reasonable cost for relocation tax deduction directly linked to moving your household goods and personal items, as well as yourself and other household members.

Some examples of tax-deductible costs are:

- Costs of transportation (gas, miles, and truck rentals)

- Fees for short-term storage

- Packing materials

- Coverage

- Hotels along the way

You can’t deduct money spent on food, house hunting, or visiting places before moving. You can’t deduct any part of the price you paid for your new home, your security deposit, or the fees you had to pay to get out of your lease.

To claim your moving costs, complete Form 3903 and attach papers or proof that you paid for them. On the IRS website, you can learn more about how to do things.

Key Tests to Qualify for Deduction

If you are moving because of your job, you may wonder if you can count the cost of hiring professional movers as a tax deduction. Yes, but only if you meet some requirements set by the IRS.

Time Test

You must work full-time for at least 39 weeks in the first 12 months after you move to the general area of your new job. If you are self-employed, you must work full-time for at least 39 weeks in the first 12 months and for at least 78 weeks in the first 24 months after you move to the general area of your new job. My friend participated in the test while he was moving.

Distance Test

Your new job must be at least 50 miles farther from your old house than your old job was. For example, if your old job was 10 miles from your old home, your new job must be at least 60 miles from your old house.

Know if moving in autumn or winter can save money and improve renting terms.

How to I claim the Moving Expenses Deduction?

If you move because you got a new job, you might be able to take some of your moving tax deduction.

Here are the steps you need to take:

Find Out If You Can Get A Discount

You have to meet three requirements, distance, time, and job-related requirements. The distance test says that your new home must be at least 50 miles farther from your old job than your old home was. To pass the time test, you must work full-time for at least 39 weeks in the first year after you move to a new place. The job-related test says you must move because you are starting work at a new place.

Get All Of Your Bills And Records Together

You can deduct a reasonable tax deduction for moving for yourself and your family. You can’t write off money spent on meals, travel, or looking for a new home. You must keep bills, credit card statements, mileage logs, job reimbursements, and other records of your moving costs.

Fill Out Form 3903 And Connect It To Form 1040

On Form 3903, you list your moving costs and determine how much you can claim. You need to put in the amount of your moving costs, any money your company gives you back, and the amount you want to deduct. You also need to declare in 3903 moving expenses why you’re moving and how far your old and new homes are from each other.

Fill Out Schedule 1 Of Form 1040 To Claim Your Exemption

On line 12 of Schedule 1, put the amount from Form 3903 you want to deduct for moving costs. This amount will lower your adjusted gross income, which will lower the tax you must pay.

Moving can be exciting and challenging, but it can also be expensive. By claiming the moving tax deduction, you can get some of your money back and have more fun in your new home.

People Also Asked

Do movers charge sales tax in Texas?

Yes, movers charge sales tax in Texas. The Texas Comptroller of Public Accounts says that moving services are subject to both state sales tax and any city sales tax that may apply. The tax rate changes based on where the service is done and what kind of service is being done.

For example, the whole cost is taxed if you hire a mover to pack, transfer, and unpack your things. But if you only hire a mover to get your things from one place to another and pack and unpack them yourself, you only have to pay tax on the transportation fee.

Do movers charges include sales tax?

Yes, some states require movers to add sales tax to their prices, while others let them list sales tax separately on their bills. Some movers may include sales tax in their prices as a courtesy to their customers, while others may not. You should always ask your mover to break down their prices and tell you if they include sales tax.

Does Ohio charge sales tax on movers?

No, Ohio does not charge sales tax on movers. The Ohio Department of Taxation says that moving services do not have to pay sales tax in Ohio. If you hire a mover in Ohio, you don’t have to pay sales tax on packing, moving, and unpacking your things.

To sum up, paying professional movers can be a smart and easy way to move, but it may not always be tax-deductible. The IRS has strict rules about what counts as moving costs, and you have to meet them if you want to get a credit.

Before you file your taxes, you should talk to a tax pro to ensure you are qualified and have all the proper paperwork. Know if you can cancel movers.

- How to Prepare Your Lawn Tractor for Moving - March 24, 2024

- How to Prepare for Moving in the Snow: Guide for Prevention - March 24, 2024

- Tips to Get a Precise Moving Quote - March 19, 2024