You need to save at least $8k for moving out. But be sure you need more than this amount to move.

According to a report, one-third of Americans live with their parents. If you want to move alone to a new place suddenly, bills, rent, and moving costs must be fixed in advance for your survival. Moreover, depending on the situation, distance, and location, the cost can fluctuate from $12k – $16k.

For example, if you go from one renter’s apartment to another renter’s apartment, then there is a kind of cost when you go from rent to your own house or condo there is a different amount of cost. Besides, the cost of moving during the move, the cost of a device to help move heavy objects, certification, and many other things are also included.

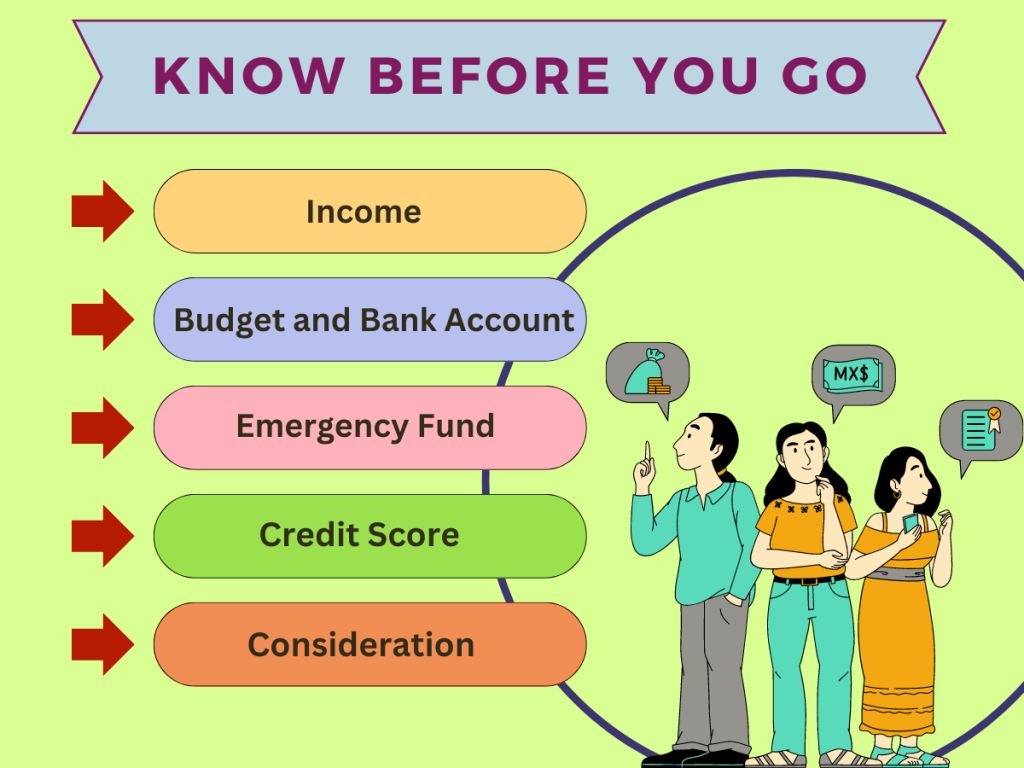

Know Before You Go: Self-Assessment for Moving Out

Before moving out, you should look into your affairs. The key points in it are-

- Income: Your income should be 3 times your rent. Which can ensure you a prosperous life. And of course, your income source should be stable.

- Budget and Bank Account: Budget in advance for any work such as your rent, and bills, including their social costs. What range do you want these at? Or decide how much range you want before moving. Try to keep your account in good standing and keep a sufficient amount of backup in the account to be used in case of emergency.

- Emergency Fund: Have an emergency budget to save before moving out. May come in handy during move-out. For example, to replace or remodel something.

- Credit Score: Check your credit when moving. Because moving costs can change a lot, check your credit beforehand.

- Consideration: Rent or travel costs vary a lot depending on the location and space of the accommodation. Money management becomes easier if you are careful in selecting all those cases.

Mastering the Art of Assessing Your Financial Situation

Your way of living comfortably depends on your financial situation. Here is how you can get it or what tips you can follow for having it-

A. Creating a Detailed Monthly Budget

Share a monthly budget in advance. How much is your income, and what are the essential expenses such as bills, fees, and rent, keep these separately. And calculate how much money you have left after paying them.

Since you will be moving there are some fixed expenses that you have to pay. They include move-in payments, new essentials, and more. Also, you have to think about some additional costs like repairing something if it breaks, or whether you need to get a new propane tank in case of a long move.

If your spending habits are high, bring it under a bit of control. What you can do is, if you have a habit of having coffee at Starbucks or 7-Eleven, try making it at home. Avoid purchasing things you don’t need. You will see that your money management has become easier, and you have enough saved before moving out a lot of money at the end of the month.

B. Managing Your Debts

The debt-to-income ratio is sometimes called the debt-to-earning ratio. That is how much percentage of your total income you will repay the loan. Suppose your income is $1,00,000 and you are repaying a loan of $40,000 monthly, then your debt-to-income ratio will be 40%.

But usually, the government fixes this rate which is less than 43%. This is because there is a comparison of income and price of an apartment, house, or condo. But here this ratio depends a lot on your preview loan and bank history.

It is best to have a lower ratio, it will be possible to manage your income and loan well. But pay down debt before you move out of an area or out of state. Try to take debt in a new place that has a high-interest option.

C. Estimating Living Costs

Point out and list your daily and essential monthly expenses in advance and keep that amount aside. This includes things like rent, bills, monthly groceries, and travel expenses. For a stable and secure living, save enough money to cover all your expenses for the next 3-6 months.

Of course, you cannot accumulate this amount in one day. So start small. Initial deposit $1k -$2k. But must reduce the waste of money by buying unnecessary things. And stay strict on your monthly budget.

If possible, avoid eating out, eat at home or take lunch from home, you will see that you can save before moving out at the end of the month.

Decoding Income and Rental Affordability Before Moving Out

Check your income savings before moving out. If you choose a residence that is comfortable and reasonable for you, it will also make sense of saving money.

Your income should be in such a ratio that your income is 3 times more than your rent. Then the amount will be enough to cover your essential expenses. Try making a side income source using your skills.

If you are in comfort then it is more cost-effective to rent a house with a roommate. As the cost of your rent will be reduced, the bills, and maintenance costs will also be reduced to a great extent. But you must be such a roommate that your lifestyle should match.

Otherwise, you have more disadvantages than advantages. If you stay with a roommate, you will see that your total cost will be reduced by half.

Transition Time Management: Keep Tabs on Progressive Relocations Schedules, Metrics

Before you start moving, check your deadlines and notice periods carefully and plan accordingly. For example, when to leave the old house, when to hire the movers, and when to clear the bills before moving.

Make a thorough checklist of everything. Which one should be moved, which one should be kept, which one should be sold in the local store, how would they charge to carry them, can that charge be reduced somehow, check out those things and make moving more comfortable.

Start your packing before the movers arrive. Start packing 5-7 days before. First, pack all the things that are very important and connected with your sentiments. Pack your clothes, and documents well and label them to identify them.

Capitalizing On Trust-Tinged Buying To Save

Trust-tinged buying means the item is from a trusted seller that is filled with substantial reviews and testimonials. On the upside, buyback credit is when you buy an item and later sell it back in the store at a fixed rate proportional to its quality.

Suppose you buy a grill if it is usable enough while you are moving you will get an amount back of 50% of the total price. This will reduce your bearing cost and you will get a good amount.

Apart from this, you can incur a lot of costs related to the warranty of a product. If you think your geyser is broken, you can get it repaired free of charge if you have a warranty card. And was able to save enough money to move out.

Building Your Safety Net: Save Enough to Thrive for a Year

You are financially stable now but due to some unusual fact, you may become financially unstable. For your safety and stability, you need to have enough savings to back you up for a few months to cover your monthly living expenses including rent, fees, and other essential expenses.

Ways you can save include-

- Set a goal to accumulate this amount within this period.

- Make a budget and try to stick to it.

- Cut down on unnecessary shopping and eating out.

- Stay at home and do something creative.

- Try doing something that utilizes skills as a side income source.

- Start by setting up an emergency fund.

- Stop buying beautifying items for the house now, but buy little by little in the future.

Embrace the Charm of Secondhand Furniture

A large part of the cost before and after moving is the cost of a device to help move heavy objects, bringing furniture from the previous place to the new place and the cost of fixing it again in the new place.

You can reduce a small part of this cost by buying secondhand kinds of stuff. You don’t have to change your bulky furniture, but other beautifying items like wall mats, and tea tables are better to get second-hand. If you bring those beautifying things from old residents then the moving cost may increase as the weight increases. And buying a new resident would be costly too.

So, it’s better to have a secondhand one. And the condition of those secondhand things isn’t that much worse. If you select it wisely, sometimes no one will realize that it’s not new.

You can easily find these secondhand items online, and you will find many options here. As well, the price of these things is several times less than the new one. Again, you can also check things out in person by going to a thrift store.

So, How Much to Save Before Moving Out?

The cost of moving out varies depending on which location or state you are going to, whether you own or rent an apartment, and what the number of rooms the house has.

However, some details about how much amount to save before moving out of state should be good for you are given below-

Is 10k enough to move out?

You may consider this to be the beginning point. For a few months, this sum of money can be used to pay your rent, electricity, food, and other expenses. However, it should be mentioned that this money could not be enough for your move out if you live in a really expensive neighborhood or a very expensive state.

Is 15k enough to move out?

It has a comparatively stable value. With this kind of money, you may cover your vital costs for a few months, including bills, fees, rent, and some money for furniture, appliances, and other necessities. However, this amount will be sufficient if you wish to downsize to a single room or share it with someone.

Is 20k enough to move out?

The $20K amount saved before moving out is a substantial sum of money. This kind of money will pay your critical costs for a few months, provide you with enough funds to buy furniture, appliances, and other necessities, and offer you some extra cash to put away for the future. Use it as the suggested amount for moving out.

Is 30k enough to move out?

This is enough for you to cover a few months of needs plus moving-out expenses. You can also get expensive residents at this amount.

Moving out is not an easy task. How to move as well as how much will be spent, how much amount to save before moving out, how to manage it, and how to manage the loan are all “how” discussed here.

Moreover, you can know that if you keep a certain amount, you will be able to handle the whole matter of moving out.

- How to Prepare Your Lawn Tractor for Moving - March 24, 2024

- How to Prepare for Moving in the Snow: Guide for Prevention - March 24, 2024

- Tips to Get a Precise Moving Quote - March 19, 2024