Yes, you need additional insurance for movers.

But it depends on the circumstances, including when the movers lost or damaged your belongings. Additional insurance isn’t a must in every situation.

Additional insurance is a kind of backup given by a third-party company to prevent any unwanted financial loss by the movers.

Moving company insurance may cover expected facts and additional insurance cover unexpected facts. And to know in detail, go through the blog.

Additional Insurance for Movers: Factors to Consider

There are mainly two types of moving insurance coverage: released value protection and full-value protection.

But except this, third-party companies offer several additional insurances to prevent unexpected losses.

But your insurance won’t cover the damage that you cause. Know when additional insurance for movers is applicable-

Full Replacement Value Coverage

It’s mainly kind of full value protection moving insurance and usually offered for long distance moving.

In those cases if the movers lost or damaged any of your valuable belongings including art, showpiece, antiques and so on, then the insurance covers the fact but the valuation must be decided by the movers, not by you.

Includes Scratches and Dents

If the scratches and dents are caused by the movers while moving then the additional insurance must cover the repair cost.

When my cupboard got a huge scratch from movers during my move last winter, I became very anxious and wasn’t so sure about whether I’d get any coverage from my insurance. However, I contacted the movers company and got the coverage. Surely, it was a big relief!

But in those cases, you need to submit proper paperwork with proof.

Control over Claims Process

I found that moving insurance coverage companies allowed me to choose my claim process. But before that, you need to check the available options. Then select the repair or replace whatever you want.

And even you can get it a bit fast. As you have control over it so you can repair or replace any damage belonging properly in low expenses and less time.

Peace of Mind with Protection

You can choose this coverage in the shape you want from the third-party insurance company. It can be expensive sometimes but must protect against any losses and damages to your stuff while moving.

But must have pictures and videos of your belongings before moving to support protection. When I was struggling with my move, I found so many moving apps online that could help you manage a peaceful move with protection.

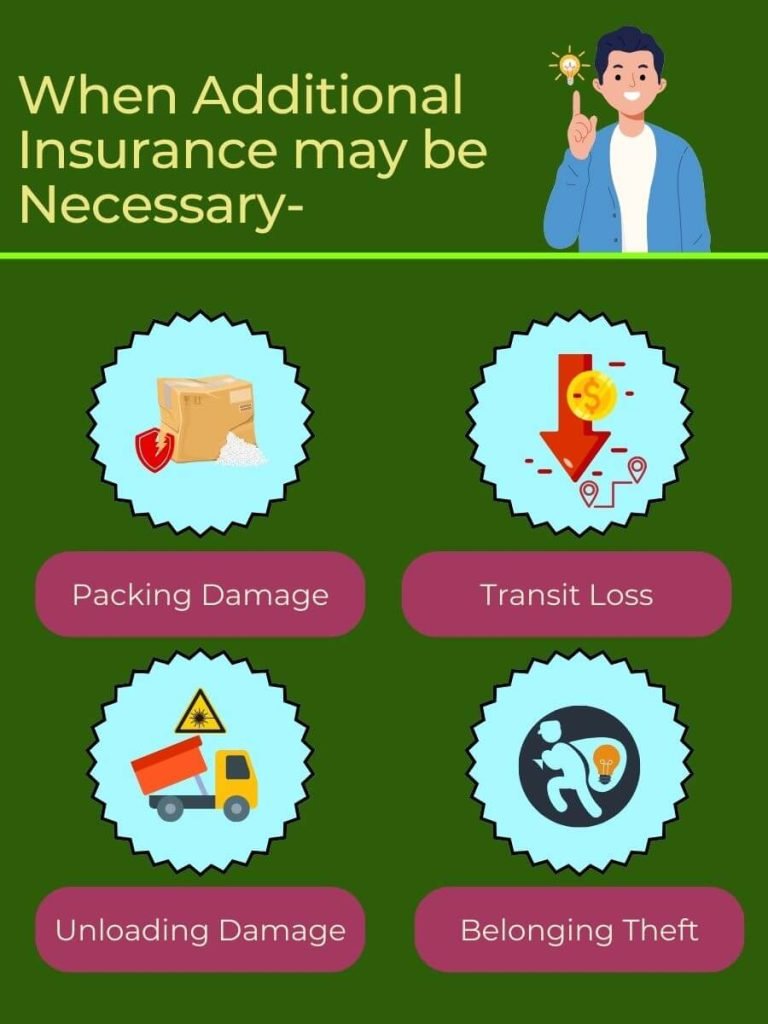

When Additional Insurance may be Necessary

It’s not a by law insurance but a needed one. It mainly covers the damages that are done accidentally while moving. The situations when the insurance for movers is applicable are-

Packing Damage

Moving company insurance may cover the repair or replacement cost but a certain portion. They won’t cover the whole expenses. To get rid of this kind of financial crisis additional insurances are the best option to choose.

Transit Loss

When any of your stuff is misplaced during moving. It can be any expensive jewelry, antiques, or any part of a big furniture without that the furniture can’t be fixed and on and on.

In that case, you will get the amount of the thing or get a new one and these expenses will be covered by additional expenses.

Unloading Damage

It can be done unwillingly or not by maintaining proper techniques by the movers. And moving companies will cover certain parts of it.

So, if the damage is severe, then additional insurance is here to support your cost.

Belonging Theft

Theft can be an unexpected and unwanted situation. If you can attach proper documentation with the claim, then additional insurance must cover your losses.

Types of Moving Insurance

There’re different type of insurance available to protect your moving. And bound to cover your certain losses or damages of belongings during moving. That includes-

Released Value Protection

It’s a kind of basic value protection that covers both local and long-distance moving. But a matter of sorrow that it won’t cover the market value of the stuff.

It covers $0.30 per stuff per pound for long-distance moving and $0.60 per stuff per pound for local moving.

Suppose during your long-distance moving, movers break one of your antique showpieces of a pound whose market value is $1500 but this insurance will only cover $450. It doesn’t matter how expensive the item is, you will only get $0.30 in your case.

Full Value Protection

It covers almost all of your loss which must be more than basic coverage (released value protection).

If your belongings are lost or damaged by movers, the moving company will offer three options to you – repair, replace, or give the market value of the stuff.

But it doesn’t cover too expensive items such as diamond jewelry.

For example, movers break one of your plates during relocating, in that case, this insurance policy will offer you a new piece of that plate as a replacement, or give you the market value of the plate.

Third-Party Moving Insurance

It covers the full value of your losses that aren’t covered by moving company insurance. It’s related to moving companies but as the companies aren’t allowed to sell any insurance. So that third party plays a medium role. It covers the full value of losses and damages that weren’t covered by the moving company.

Suppose the dresser got stretched while moving and moving insurance coverage doesn’t cover this. In that case, third-party insurance can help you out.

How to Obtain Additional Insurance

When you are moving in your state or outside your state you must require some additional insurance. As no one guarantees a 100% safe move. And the insurance by moving companies isn’t enough to protect against losses and damages.

For this additional insurance is a must. Know here how you can get this-

Directly Through the Moving Company Insurance

Moving companies offer additional ones with released value protection and full value protection. That is called valuation coverage. It’s a bit expensive and gives more coverage than basic coverage.

And you also get available options of different levels to find the best one for you. Whenever I see anyone anxious about moving, I suggest they find a worthy moving company that offers different insurance options as per their choices.

Third-Party Insurers

They give you additional coverage but less than valuation coverage. But from here you can select the level that you want to cover the most of losses.

Existing Homeowners/Renters Insurance

Sometimes these types of insurance are attached to rental insurance and support your expenses while moving in and out. Go through the options and facts available here and find out if they match for you.

How Much Does Moving Insurance Cost?

The moving insurance that is provided by moving companies covers 1% – 2% of the real cost of any lost or damaged belongings. But not more than that. Also, while long-distance moving, the percentage is slightly lower.

On the other hand, my brother shared with me that third-party insurance is a bit expensive and covers 1% – 5% per pound for each item. These values fluctuate with the thing you are moving, state, and type of moving company.

For example, one of his damaged items cost $25,000 and weighs 1000 pounds. Moving insurance covered $375 for his damage whereas third-party insurance was ready to cover up to $1250.

People Also Asked

Does Renters Insurance Cover Moving?

Yes, renters insurance covers moving.The renter insurance policy covers moving in and out but it may vary from state to state and renter to renter. It’s not a mandatory one but needed. It may cover the losses and damages your belongings have during moving. It’s a smart move from renters as they can ensure the safety of their property too during your moving.

Does a Moving Violation Affect Insurance?

Yes, moving violations affect insurance.

Violation isn’t an expected term during moving. And it depends on the moving company, state, type of insurance that how this affects the insurance. If there is a solid point with enough evidence then the situation can be handled.

No doubt moving is a risky and critical task. But insurance policies are there to help you out from any financial losses during moving. Not only by laws insurances are available but also a number of additional options are available too to make the moving easy. Before purchase one must know about their ins and outs.

- How to Prepare Your Lawn Tractor for Moving - March 24, 2024

- How to Prepare for Moving in the Snow: Guide for Prevention - March 24, 2024

- Tips to Get a Precise Moving Quote - March 19, 2024